THANK YOU FOR SUBSCRIBING

Editor's Pick (1 - 4 of 8)

When Science Fiction Becomes Science Fact: An Industry Embracing Monumental Change

Stephen Barnham, Senior Vice President & Chief Information Officer, Metlife Asia

Stephen Barnham, Senior Vice President & Chief Information Officer, Metlife Asia

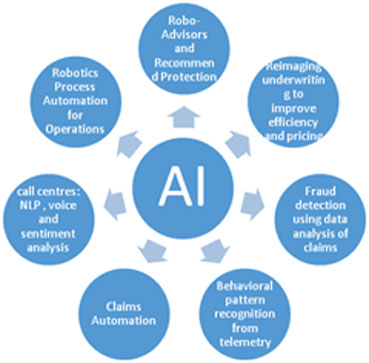

The new model would be faster, easier and more accurate. More importantly, it may expand coverage to individuals that previously couldn’t be covered, because the analytics would allow the insurer to become proactive partners in improving customer’s health, helping them manage illness and enable them to live long and healthy lives.

We are already seeing AI play an increasingly active role in the auto insurance industry. Black-boxes that track the quality of a motorist’s driving, have changed the pricing landscape and AI is now helping to improve efficiency on the back-end with one insurer using it to interpret photos of collision damage for claims loss adjustment.

AI is also offering significant efficiency benefits to insurers when it comes to back-end processing. Many insurers have large, paper-laden back offices, AI-driven robotics is helping to automate manual, mainly monotonous tasks to free up staff for more value-added activities. Insurers are also using AI pattern recognition and big data algorithms to trawl vast troves of claims data to reduce cases fraud, which would have previously been difficult, and time-consuming to detect. For example, if a medical practice is consistently issuing unnecessary prescription drugs that don’t match the patient’s diagnosis, AI can be used to detect these patterns of fraudulent activity.